The Importance of Financial Accountants and Advisors for Your Business

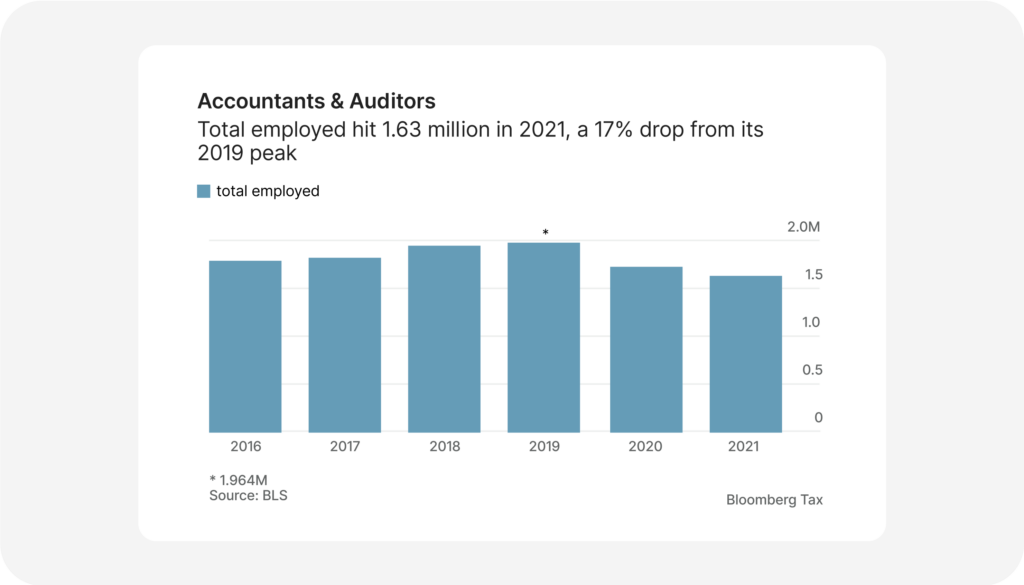

As businesses grow and financial complexities increase, the demand for skilled financial professionals is skyrocketing. However, the supply of qualified accountants seems to be struggling to keep up with this rising demand.

The Accountant Shortage: Unraveling the Challenge

The shortage of accountants is not a new problem, but its impact is becoming increasingly severe in recent years. The reasons for this crisis are multifaceted:

- Economic Growth and Complexity: As the global economy expands, businesses have to navigate complex financial regulations, tax laws, and reporting standards. These complexities demand specialized expertise from financial professionals.

- Aging Workforce: The baby boomer generation is reaching retirement age, resulting in experienced accountants leaving the workforce. The number of graduates and new entrants into the accounting field is not enough to fill this gap.

- Technology Advancements: Automation and artificial intelligence are reshaping the financial landscape, automating repetitive tasks that were once done manually. While technology streamlines operations, it also calls for accountants with advanced skills in data analysis and interpretation.

- Changing Education Trends: Fewer students are pursuing accounting degrees, leading to a decline in the number of qualified professionals entering the industry.

When and Where Do You Need Financial Accountants and Advisors for Your Business?

Now that we’ve explored the accountant shortage, it’s vital to understand when and where your business needs the expertise of financial accountants and advisors. Here are some critical scenarios:

- Startup Phase: When you’re launching a new venture, having a financial accountant is invaluable. They will help you set up your financial systems, create budgets, and provide insights into financial projections.

- Tax Planning and Compliance: Tax laws can be complex and ever-changing. A financial advisor can help your business navigate tax regulations, minimize tax liabilities, and ensure compliance.

- Financial Reporting: Whether it’s monthly, quarterly, or annual reports, having an accountant to prepare and analyze your financial statements ensures accuracy and provides valuable insights into your company’s financial health.

- Business Expansion: When your business is growing, you need strategic financial planning to manage cash flow, assess investment opportunities, and optimize financial resources.

- Mergers and Acquisitions: During business acquisitions or mergers, financial accountants and advisors play a crucial role in conducting due diligence, valuing assets, and assessing financial risks.

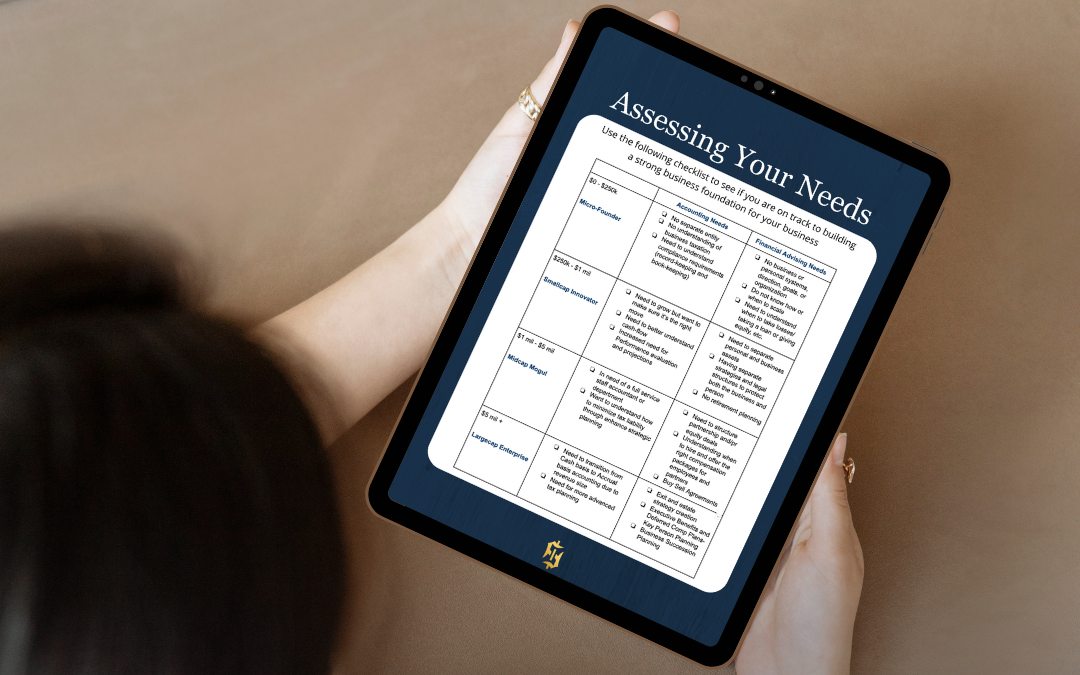

Download Your A-Team Checklist

To ensure your business has the best financial support, download our exclusive A-Team Checklist. This checklist will guide you through the essential qualities to look for in financial accountants and advisors, helping you build a solid financial team that drives your business forward.

Click here to download the A-Team Checklist and secure your business’s financial success!

The accountant shortage poses a significant challenge to the financial industry, but businesses must continue to thrive despite this obstacle. By recognizing the importance of financial accountants and advisors, businesses can make informed decisions, stay compliant, and achieve long-term financial goals. Thank you for reading, and we’ll be back soon with more valuable insights from the world of finance!