Did you know there are several ways to let your money make you money? Including, putting your money into a high-yield savings account. Yes, that’s all you have to do, is just put your money into an account that will pay you to keep it there. You can literally make money while you sleep!

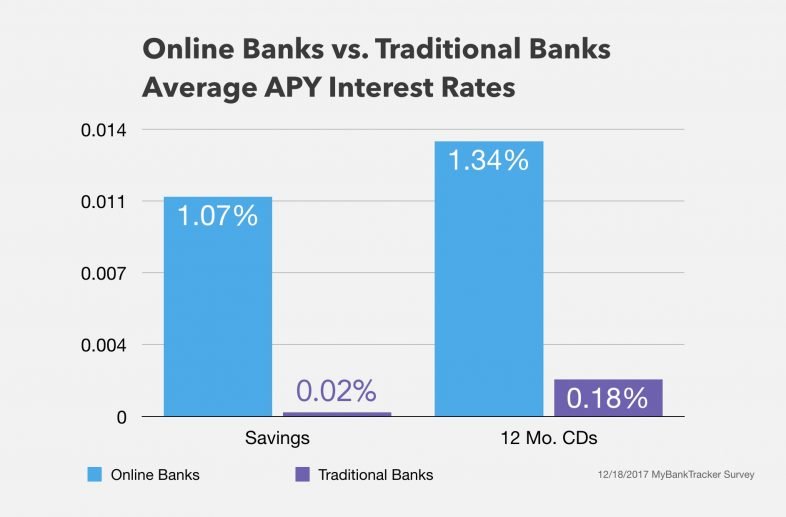

A traditional savings account is a great way to save your money and earn more over the years. However, most of the traditional banks require you to pay high fees but have low interest rates. The average rates from traditional banks goes from 0.01%-0.07% annual percentage yield (APY). With this type of rate, you are paying more for fees than interest earned on your traditional savings account.

Is there a better savings account where you can receive more money? Yes! high-yield savings accounts are online banking with higher annual percentage yield for consumers and have lower or no fees. They offer safety, growth, and ease of use. With a high-yield savings account your emergency funds can grow fast with over 1.50% APY.

While you are searching for a high-yield savings account, make sure you are looking for the ones that are insured with FDIC to protect your deposits from bank failures. Also, compare the rates and requirements that each one offers. Once you find the best one for you, complete the application online, deposit money, and begin saving! If you download the online bank app and turn on alerts for notifications, you can see how much you are saving each month!

Here are 4 high-yield savings accounts with over 1.50% APY, insured with FDIC, and $0 of monthly fees as of July 14th, 2022:

- BrioDirect = 1.80% APY

- CitBank = 1.65% APY

- Bask Bank = 1.61% APY

- LendingClub = 1.52% APY