Remote or hybrid work is the new standard for employers who want to attract and keep top talent. But does having a remote or hybrid job mean that you can qualify as “Working From Home” when it comes to filing your taxes?

The IRS has specific requirements for individuals to qualify for the home office deduction. Let’s review some of them below:

- The home office deduction is only available to qualifying self-employed people.

- You must use your home “regularly and exclusively” for business during the tax year.

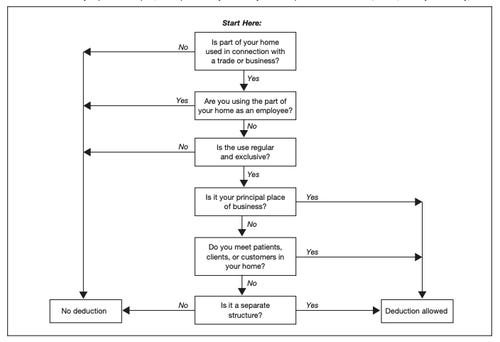

Here is a quick chart from the IRS that helps guide you to see if you may qualify for the deduction:

If you are able to meet these requirements, you may be able to deduct part of the cost of your home expenses. Identifying which expenses you can include can be a bit challenging, so it’s always recommended that you review your proposed deductions with at CPA to make sure that you are maximizing your opportunity to claim your business expenses.

For many people who are now working remotely, this deduction will not apply to them because the work that they are doing is as an employee.

However, if you are currently an employee that is considering transitioning to a more independent option such as becoming an independent contractor, or starting a business in your spare time, you may have opportunities to deduct other expenses that are related to your business operation.

Whichever category you qualify for, it’s always important and beneficial to create a tax plan ahead of tax season, and to review that plan during the year to make sure that you are sticking with it!

Fola Financial is here to help you create a plan to meet your personal and professional goals, and evaluate how you can reduce your tax liability and maximize your deduction whether you file taxes as an employee or a business owner.

Thanks for sharing this post! I am finally overcoming my fear of establishing a TAX Strategy. Collaborating with experts and resources like this is super helpful.