Sheneya Wilson and Michel Valbrun joined Anthony O’Neal on his podcast to discuss all things taxes and accounting. These financial gems are split into a series of videos, and you can also watch the full interview as well!

The Cost of Being Your Own Boss

The Great Resignation has resulted in many former employees considering or becoming their own boss. While this shift in one’s title is a level up in many ways, it comes with an increase of responsibility when it comes to paying taxes that many people aren’t aware of. This additional responsibility can actually provide benefits that W2 employees cannot take advantage of.

Let’s review some things that everyone should know if they want to work for themselves.

Tax Payments

- Self-employed people receive compensation that does not withhold their required tax payments. Instead, they are responsible for paying quarterly estimated taxes on their income. Due to this, it’s important to track monthly and quarterly income and set aside money for tax payments.

- Instead of receiving a W2, the self-employed receive a Form 1099 from each entity that has paid them, this document details the amount they have earned. Making accurate quarterly estimated tax payments throughout the year can reduce tax liability at the end of the fiscal year.

- Self-employment taxes are 15.3% of earned income, of which 12.4% goes toward Social Security and 2.9% goes toward Medicare.

Tax Savings

- Self-employed people benefit from being able to claim deductible business expenses on their taxes. They can write off half of the self-employment levy, phone bills, internet expenses, costs associated with a home office, and more.

- Self-employed people are eligible to open a simplified employee pension plan, known as a SEP IRA. Through this plan, 25% of net earnings from self-employment can be saved.

- Health insurance premium payments can be claimed as a tax deduction for the self-employed.

- Entrepreneurs with businesses filed as pass-through entities, including S-corporations and LLCs may also benefit from the 20% qualified business income deduction that is subject to limits based on income level and industry.

Of course, everyone’s individual situation will vary, which is why speaking with a CPA can help you to create a plan that will help you plan your tax strategy before tax season even begins.

If you recently made the transition to being self-employed and want to prepare for the upcoming tax season, consider scheduling a consultation call with Fola Financial to learn more about how our services can help you to create a smart tax strategy and reduce your tax liability. Click here to get started!

Tax Planning Is For EVERYONE!

We’ve all seen the news about how some of the wealthiest people in America reduce their tax liability every year. This isn’t a benefit exclusive to the wealthy, it’s available to EVERYONE who takes time for tax planning!

Tax planning is an essential part of wealth accumulation and sustainability.

The purpose of tax planning is to ensure tax efficiency through the implementation of strategic analyses and strategies aimed to reduce your tax liability.

However, tax planning takes place year-round — not just when you’re preparing for tax season.

Here are a few strategies that you can implement that can make an impact:

- – Analyzing your business tax structure

- – Hiring your kids

- – Paying yourself via payroll

- – Contributing to retirement accounts

- – Pre-paying expenses

Of course, working with a tax professional is the best way to help you assess your current tax liability, and make strategic changes to reduce your liability in preparation for the upcoming tax season.

Fola Financial offers clients quarterly tax planning packages that help individuals and businesses plan their tax strategy year-round!

If you’re ready to learn more about how you can benefit from tax planning, book a consultation with Fola Financial today!

Retirement Planning 101

Nowadays it’s more common for people to switch jobs or careers every 4.2 years than it is for them to stay at the same job until retirement. Whether you are a full-time employee, have a part-time hustle, are fully self-employed, or have employees of your own, it’s important to understand the different ways to plan for retirement in order provide yourself (or your employees) with the best options for retirement.

Here’s a quick overview of the most common retirement plans :

401K

What is it?

- A tax-advantaged, defined-contribution retirement account offered by many employers to their employees.

- Workers can make contributions to their 401(k) accounts through automatic payroll withholding, and their employers can match some or all of those contributions.

- The investment earnings in a traditional 401(k) plan are not taxed until the employee withdraws that money, typically after retirement.

Roth IRA

What is it?

- A special retirement account where you pay taxes on money going into your account, and then all future withdrawals are tax-free. Roth IRAs are best when you think your taxes will be higher in retirement than they are right now.

- You can’t contribute to a Roth IRA if you make $140,000 as a singles individual or $208,000 as a married couple.

- In 2021, the contribution limit is $6,000 a year unless you are age 50 or older—in which case, you can deposit up to $7,000

Roth 401K

What is it?

- A Roth 401(K) is a tax-advantaged retirement savings vehicle that combines features from traditional 401(k) plans and Roth IRAs

- Contributions and earnings can be withdrawn tax-free as long as certain criteria are met

- For 2020 and 2021, the contribution limit is $19,500 and those 50 and over can contribute an additional $6,500

If you are starting a new job and are unsure which plan to select, here’s something to consider!

A Roth 401(k) can be rolled over into a Roth IRA when you leave your job or retire which will eliminate the Required Minimum Distribution(RMD) Requirement. This is best used if your retirement savings and retirement income (Social Security, pension, etc.) are currently heavily weighted towards tax-deferred assets.

Do you have specific questions about retirement planning and establishing generational wealth?

Click here to register for a free webinar on August 19th, 2021!

Make the Tax Code Work For You

Every tax payer has the opportunity to benefit from the tax code, when they have knowledge of how the tax code works and take the steps to tax plan throughout the year.

This may seem like an intimidating endeavor at first, but by working with a tax preparer to create a tax plan for your specific needs, you can set up a system of habits to set you up for success before tax season even starts!

Creating a system of habits can encourage you to think about how you are investing your money into your education, business or plan for retirement, versus simply spending your money on the latest trends.

Shifting your mindset and actions can benefit you in the long run by enabling you to have a record of your expenses, as well as any possible tax deductions.

In fact, a little bit of knowledge about how tax codes work, can benefit you in the long run, especially when you partner with a tax prepration team that has your best interests at heart.

Fola Financial is here to help you achieve that goal by legally and ethically reducing your tax liability through the use of tax advantage savings strategies, tax sheltering, and deductions/credit maximization!

If you’re ready create a tax plan that will help you make the tax code work for you, click below to schedule your free tax prep consultation:

Click here to watch the video feature and read the article.

What’s Your Income ID?

We are officially in the 2nd half of 2021! This is a great time to check in with ourselves to see if our income goals are matching what’s in our accounts!

So let me as you this question…

That’s right, your income ID? This one little letter could be the difference between you working for your money and your money working for you!

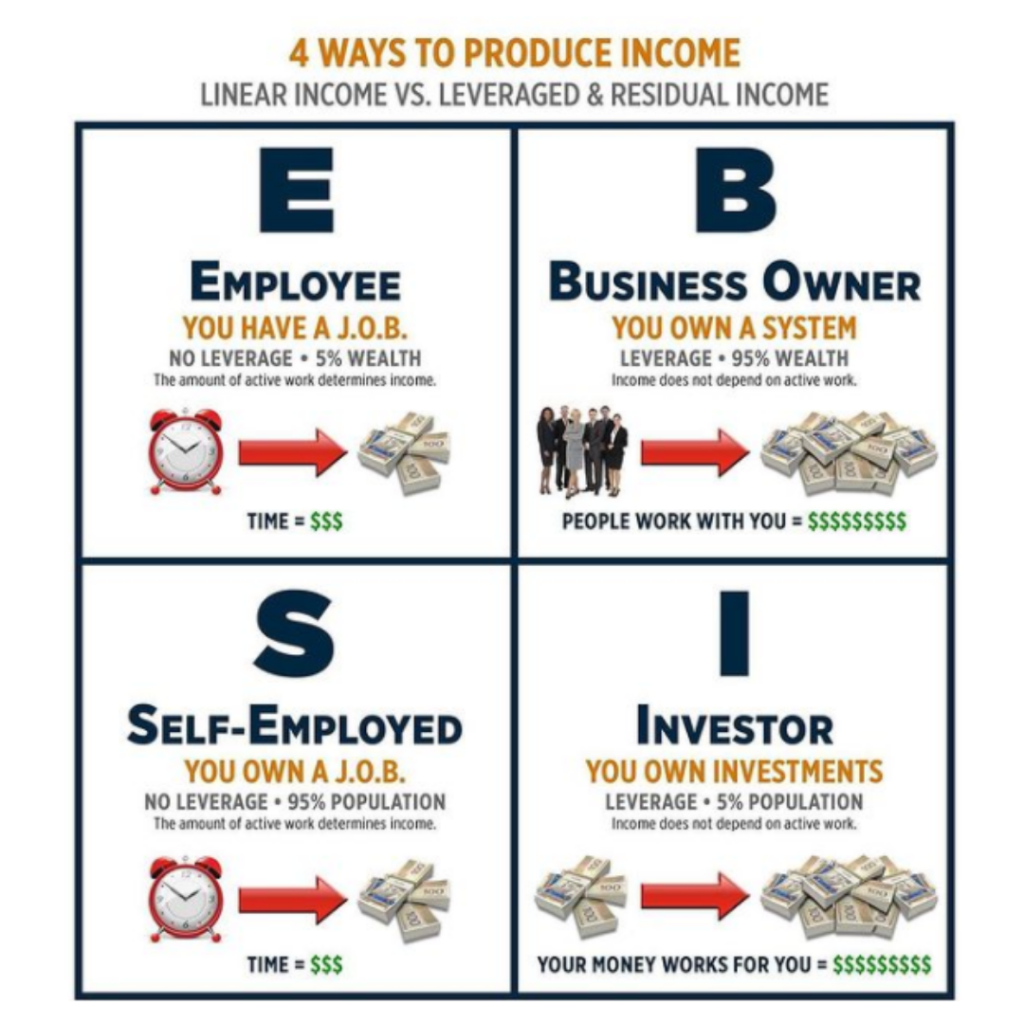

Five years ago I read Rich Dad Poor Dad by Robert Kiyosaki, where I learned about the four ways to produce income. Think of each of the below quadrants as your income ID:

After reading the book, my perspective about wealth shifted drastically.

Back then, I was working at a “Big Four” accounting firm trading my valuable time for money … and it wasn’t even much. A 65k salary is around 45k after taxes… A six figure salary sounds good, but that does not mean you pocket 6 figures.

In fact, most individuals that make six figures pay close to 40% of their income to the IRS and State & Local governments. Ouuuchhhh!

Just to put it into perspective, I have clients that net around 1-2 million and pay less than a 28% effective tax rate (both federal and state combined).

I started Fola Financial 3 years ago, and moved into the S quadrant (self- employed). I was determined to free myself, but noticed that I was still trading much of my time for money .

The thing about entrepreneurship is that you typically do start there, but the goal is to eventually move into the B quadrant (Business owner), which is focus on when advising my clients.

Yes, contrary to popular belief, there is a huge difference between being self- employed versus a business owner.

If your goal is “financial freedom”, you want to move into the B & I quadrants ASAP.

Over the past 3 years I buckled down and turned Fola Financial into a B business. Meaning that if I need to take a 3 month break, the business will still operate on its own due to the systems and processes I implemented, and of course my amazing staff.

I grew a passion for passive income and moving into the I quadrant (Investor) in 2019. With my current real estate portfolio, I make more than enough in monthly cash-flow to cover my monthly expenses, so technically I am already “financially free”. (This doesn’t even include income from Fola, my other businesses, or my stock portfolio).

I share this because as we are living in such unprecedented times, it is important to be aware of how the decisions you make now affect the life you will have in the next 5-10 years.

If your goal is to live financially free, learning how to shift your income ID to B or I, ideally both is better, is key!

Want to meet with Fola Financial to discuss your plan to achieve your goal income ID? Click below to schedule a consultation or browse our services!

Tax Planning for Small Businesses and Entrepreneurs

Starting a business can be greatly rewarding and a lot of fun. But there’s one aspect that most small business owners and entrepreneurs dread – doing taxes.

One survey asked small business owners what made owning a business great for them. Almost everyone (96%) said they loved the flexibility of owning a business and the feeling of control it gives them.

When asked what they really don’t like about business, the majority singled out bookkeeping and taxes as being especially draining. In addition, the more time they had to spend on these tasks, the more they loathed doing them.

But no matter how you may feel about taxes and tax planning, these activities are important for all businesses, and can be the difference between failure and survival. In fact, businesses that take the steps to implement good tax planning not only increase their chances of survival, but also thriving.

If you’ve not paid much attention to your tax obligations as a small business owner, it may be time to turn a new leaf. In this article, our tax experts explain what tax planning means for small businesses and how it can be the key to achieving a stellar financial year.

What is tax planning?

Although there are a lot of technical definitions for what it means, tax planning really only boils down to being savvy about your tax obligations. Since taxes are an obligation no one can really escape from, tax planning means learning the tax rules and making them work for you.

Businesses that make the effort to understand and plan their taxes are able to manage their tax liability in the most favorable way possible. In addition, with proper tax planning, they are not only able to reduce the taxes they have to pay, they can even make money on their taxes.

Here’s how it works. Federal, state and local tax codes include a lot of rules that specify what taxes businesses have to pay, the exact rates of these taxes and when the taxes are due. These codes also include specific rules for how these taxes will be paid and on what they will be paid.

However, while the tax codes take with one hand, they also give with the other by providing credits, deductions and rules that let businesses reduce their tax liability. By utilizing these rules, credits and deductions, businesses can reduce how much they have to pay on taxes, sometimes even into the negative – meaning you get a refund instead.

Unfortunately, too many small business owners and entrepreneurs fail to recognize the value of tax planning or make the effort to implement a plan. While some of this is down to a simple lack of interest, many businesses do not have proper tax planning because the rules are so complex.

Tax codes typically run for thousands of pages and include a lot of financial and accounting jargon – definitely not suitable for public consumption. But hard-to-read tax codes should not deprive you of the benefits of proper tax planning. Certified Public Accountants (CPA) or other qualified professionals are there to help businesses understand these tax rules and put them to work in the most favorable ways.

Why tax planning is important for small businesses

Apart from the obvious fact that good tax planning helps you stay on top of your tax obligations and ensure you’re not owing taxes, there are several other benefits.

Tax planning and cash flow management often go hand-in-hand. Cash flow management paying attention to how money moves in and out of your business, so you always have enough left over for other things.

If you’re not implementing proper cash flow management, your outgoings can be more than your incoming, leaving you exposed at crucial times – such as when taxes are due. In like manner, inefficient tax planning can leave you with a larger tax liability than you expected, leading to difficulties with paying your taxes and, ultimately, a negative cash flow.

Due to the fact that tax liability means money is going out of your business, it’s in your best interest to ensure as little as possible is going out. Other benefits of tax planning include:

- Being able to reduce the amount you pay on taxes, meaning you have more to grow your business

- Taking advantage of tax rules that let you grow your business and still save on taxes, the perfect two-for-one

- Giving you granular control over your tax liabilities so you’ll never be surprised by your taxes again

If achieving financial freedom is one of the reasons you started your business, implementing proper tax planning will be one of the first steps to reaching your goal.

Now that you understand what tax planning is and why it’s important for your business, let’s quickly look at ways you can make the most of your tax planning this year.

Tips to make the most of your tax planning in 2020

Good tax planning is about learning exactly what the tax rules are and being smart about how you take advantage of them. To get you started right, here are some tips that underlie smart tax planning.

- Understand your tax obligations: It’s impossible to make the most of the tax rules if you don’t know them. Learn what taxes apply to your business, the applicable rates, the periods when they become due and everything else about your tax liability.

- Maintain proper financial books and records: Taxes are a levy on your business activities and profits for a year. If you don’t maintain accurate records of your business transactions through the year, it’s the IRS that’ll be telling you what you owe – which is never a good thing. Open and maintain proper accounting books to ensure you’re on top of your transactions and have all the paperwork to back them up.

- Implement tax forecasting: Tax forecasting is simply the practice of estimating what you have to pay on taxes either monthly, quarterly or yearly. It’s a good practice because it keeps you aware of what to expect and also gives you a dollar figure you can immediately start working on reducing or reorganizing to suit your business.

- Set aside your taxes every month: We can’t stress this enough. Failing to set your taxes apart routinely is critical to ensuring you’ll always be ready to meet your tax obligations, especially as a small business. Plus, you can even make money on those funds by locking them up in a high-yield savings account and earning some tidy interest.

- Take advantage of deductions and credits: As mentioned earlier, deductions and credits are expressly provided in the tax codes for your benefit. Failing to take advantage of them would be illogical. Keep a regularly updated list of those deductions and credits that apply to your business so you can use them as they were meant to be.

- Let an expert help you: If you’re looking at all of these and wondering where to start, it might be in your best interest to speak to a professional CPA. Even if you think you might be able to go it alone, having a CPA on your side significantly increases your chances of successful tax planning. In addition, leaving things in the hands of an expert frees you up to grow your business and make more money.

Contact Fola Financial for help

At Fola Financial, we have worked with small businesses and entrepreneurs from all over the US to implement profitable tax planning strategies. We keenly understand the tax rules and can employ this knowledge to help ethically and legally reduce your tax liability. Get in touch with us today to speak with one of our financial advisors.

You Need to Open an Online Savings Account: Barclays Review

We go online for everything. From keeping up with old friends to paying our bills. Having an online savings account is not only a convenience for us, they are also a very smart investment.

There are many online savings account to fit everyone’s needs. Most online savings accounts are FDIC-insured like other bank accounts, which means your money is safe. Some require a minimum to open an account, while others don’t.

Did You Know?

The average interest rate offered by a traditional bank is only 0.26%, while online savings accounts can offer you 2.20% APY.

As a customer of Barclays I feel confident referring others to opening an online savings account with them.

Why did I pick Barclays?

Easy.

– They only require a minimum balance of $1 to open an account.

– The APY for their savings account is 2.20%

– $5 insufficient fund fee, while others can charge around $30 or more.

– $0 Monthly fees

– Barclays is a 325 year old London based account, making them trustworthy.

– Great human based customer service support.

You may think that opening an online savings account may be complicated, but it’s actually like everything online, easy and quick.

Tax Tips For Travel Nurses

Are you a travel nurse unsure about how traveling will affect your tax situation ? Here’s some advice from a CPA on how to prepare for this upcoming tax season as a traveler.

How the 2018 tax law changes affect travel nurses ?

Employee expense deductions no longer exist. Therefore, Travel Nurses can no longer deduct travel-related expenses, mileage, CEUs, licenses, etc.

Tips For Travel Nurses in Regards To The New Tax Bill

Travel Nurses should ask for higher reimbursements for travel needs and licensing fees from their employer or agency. Since tax rates are lowered under the new tax bill, Travel Nurses should consider a ROTH IRA retirement plan that deducts tax now instead of a tax-deferred traditional 401k or IRS plan in order to avoid paying tax on that money in the future.

What records should I keep so I’m prepared to file my taxes as a travel nurse?

– Contracts – This should show you start date, end date, name of facility, address, taxable hourly rate, amount of tax free stipend

– Pay stubs

– Documents that justify how tax-free stipend was used (i.e proof of lodging, meals mileage, etc.)

How long should I keep the records (in case of audit)?

The IRS has a statute of limitations of 3 years or 5 years in the case of fraud.

For tax free income, the statute of limitations is 7 years.

Are the chances of me getting audited higher because I’m a travel nurse?

Typically everyone has the same chances 1 in 160

If you make 200k or more your chances as 1 in 80

How do I qualify to receive tax free income?

The tax code allows tax-free stipends for all ordinary and necessary expenses incurred while working away from one’s tax home. Therefore, whether or not traveling nurses qualify to receive tax-free stipends depends on where they’re working versus where their tax home is.

What’s the difference between a tax home and a permanent residence?

Your tax home is the location in which you earned your taxable income (main place of business)

Your permanent residence is where your permanently reside. For travel nurses, this will be the address listed on your nurse license.

In which state do I pay my income taxes?

You pay taxes to both the state of which you worked and the state of your permanent residence.

However, Most times, you do get credit for taxes paid in each state to offset the state tax. I recommend consulting with a CPA.

Is it true that you have to be at least 50mil away from you home to qualify for tax free stipends?

No, the IRS doesn’t have that rule, it was used by the hospital as a general rule of thumb to prevent their full-time workers from picking up contracts.

Online Savings Account Review: MARCUS by Goldman Sachs

Your savings account should be paying YOU !!!

You may have heard of the name Goldman Sachs, it is one of the best known investment banks in the United States. In 2016 Goldman Sachs launched Marcus, an online bank. It’s for customers who want a higher interest rate for their savings account and are tired of paying unnecessary fees.

The Bad (The good will make up for it, I promise)

- No Physical location, so if you need to withdraw money constantly, this isn’t the account for you.

- No Checkings account so no ATM cards, a lot of people prefer linking their savings to their checkings account for emergencies but it’s not that kind of party.

- No Mobile App, I know we’re not used to things like this because we’re spoiled with today’s technology by being able to deposit our checks and check our balance. So this is a downside for many.

The Good (yayyyy)

- You only need $1 to open a savings account. Sometimes savings accounts with good interest rate deals require an average of $1,000 minimum. This is great, there’s no excuse for why everyone doesn’t have a savings Marcus account.

- High Interest Rate Yield. The current interest rate for their account is 2.00%. Take a look at others. Regular commercial banks like, Bank of America offers 0.03%-0.06%.

- No monthly fees! Usually banks that offer such a low minimum will require you to have a minimum in the thousands range.

Marcus by Goldman is a great account overall. I will give it a rating 8 out of 10.