When it comes to business credit, most business owners do not realize the benefits. One of the biggest benefits of business credit is that it is entirely separate from your personal credit. However, to be able to leverage the many advantages business credit has to offer, your business needs to have a solid foundation. A solid business foundation includes entity formation, bookkeeping, and an active business bank account.

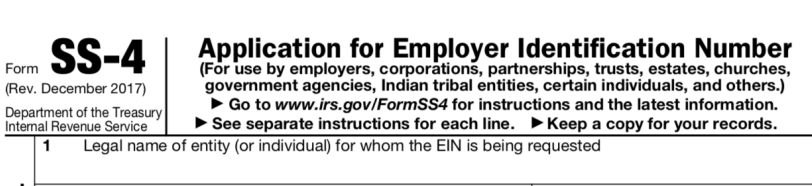

The first step in building a solid business foundation begins with the formation of your entity. The most common entity types are Limited Liability Company (LLCs) and Corporations. When you first start your business, it is important to register your business, apply for an Employer Identification Number (EIN), and apply for a DUNS number. Your EIN is a number similar to your social security number. It is how the IRS identifies your business. Your DUNS number is how your business is identified with the credit reporting agency Dun and Bradstreet.

Another important step to take before applying for business credit is to set up proper bookkeeping for your business and open a business bank account that can be linked to your bookkeeping software. Having proper bookkeeping in place will make it easier for you to prove that your business has adequate cash flow. Similarly, a business bank account separates your business expenses from your personal expenses which to accurately prove profit and loss

Next is to establish trade lines with your suppliers. If you buy supplies, ingredients or other materials from third-party vendors, those purchases could help build your business credit. Many suppliers extend trade credit, which means they allow you to pay several days or weeks after you receive the inventory. If you have this type of accounts-payable relationship, ask your supplier to report your payments to a business credit bureau. Your business credit score will get a boost as long as you stick to the terms of the trade agreement.

You need at least three tradelines to get a Dun & Bradstreet Paydex score, which measures past payment history. Even if you don’t work with a lot of suppliers, you can set up tradelines with any small vendor, such as your water or office supplies distributor. If those vendors don’t report to a credit bureau, you can list them as a trade reference on your account, and Dun & Bradstreet will follow up to collect your trade data.

A business credit card can be one of the best tools for building business credit. Additionally, many business credit cards offer benefits and rewards for your spend, from cash back to travel points.

If you have thin or poor personal credit, you may want to begin your card search by improving your personal credit score, since many card issuers will use your personal history to evaluate creditworthiness. If that isn’t possible, applying for a secured credit card will likely be your best choice.

While secured cards typically don’t offer rewards and may have a low ceiling for how much you can spend, they can still be valuable for contributing to your business credit profile. And some issuers will allow you to upgrade to an unsecured card if you can demonstrate a consistent pattern of responsible repayment.

In conclusion, having a good foundation for your business is the key to being granted business credit. Once given, you can then leverage your business credit to scale your business. If you need help building your business’s foundation, apply to become a client of Fola Financial!

Leave Your Comment