- Business structure:

Every business needs to form a business structure. There several types of business structures such as sole proprietorship, partnership, corporation, nonprofit, limited liability company (LLC), and limited liability partnership (LLP). They all have different income tax implications so be sure to understand the difference and which resonates more with your business.

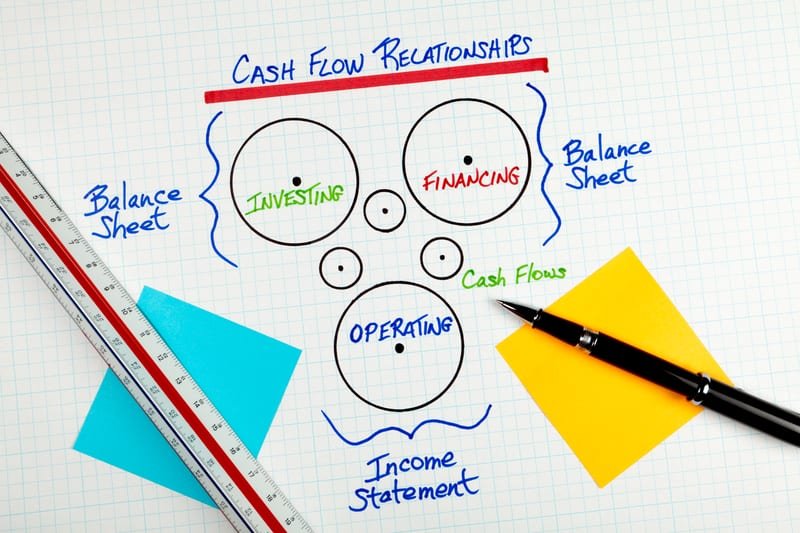

- Cash Flow vs Profit:

Cash flow and profit are both financial metrics that are always used in every business but they are very different from each other. Cash flow analysis is understanding how money is being moved in and out of the business to areas such as operating, investing, and financing activities. Profit is the money that is left over after expenses.

3. Three critical business statements and how it affects your business:

A balance sheet is a summary of the financial balances of an individual or organization. It will help investors to see where the funding should go and help manage.

An income statement is one of the financial statements of a company providing the company’s revenues and expenses during a particular period. It helps to see if your business is making profit or if there’s somewhere that needs to be fixed.

A cash flow statement is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents that come in and out of the company.This helps organize the money that the company is putting in and brings, and analysis what needs to improved.

4. Types of Business Insurance:

Professional liability insurance “covers a business against negligence claims due to harm that results from mistakes or failure to perform”. This will help cover any legal expenses that you may encounter.

Property insurance covers equipment, signage, inventory and furniture for any fire or theft emergencies.

Workers’ compensation insurance should be added to a business’s insurance policy when hiring new staff members. In case of any emergency, it helps cover medical expenses or lost wages in the job.

General liability insurance covers and protects your business from claims such as property damage, copyright infringement, or any other injuries.

Product liability insurance covers your business manufacturing products from claims and damages.

Business interruption insurance will help cover for the income loss from a disaster or catastrophic event that does occur which affects the business.

5. Proper policies, Agreements, and Contracts when hiring new staff:

When hiring a new staff, it is important to let your staff know their rights and benefits. It protects the business from any lawsuits and complaints that may happen. Most of these documents also help manage how much money to withhold from employees’ wages for state income taxes. Here are important documents when onboarding new hires:

- Form I-9

- W-4

- State new hire tax forms

- New hire reporting

- Offer letter

- Employment agreement

- Employee handbook acknowledgment

- Direct deposit authorization