Thinking of transferring your real estate property to your business entity? While Fola Financial does not assist with real estate transactions, here is some insight to consider:

You will have to transfer the deed for your property.

A deed transfer can be done with a Quitclaim deed via a title company in the state of which you purchased the property. Doing so will notify the state that you are transferring the real estate property from personal ownership to be owned by your business entity.

Transferring ownership does not transfer your mortgage.

While transferring your property ownership to your business will provide protection and leverage capabilities, it will not transfer your mortgage. Be sure to contact your lender first to make sure they are aware of the transfer of ownership and will allow you to complete the transfer, while still being personally liable to the mortgage.

What purpose does this property provide for your business?

The purpose of the investment property will need to be added to an operating agreement for your company. You will need to have a drafted operating agreement for the company that includes the purpose of the investment property. This can be done by contacting a lawyer or by using operating agreement contract templates.

Update all current contracts that involve the property.

Once the deed transfer is complete, any contracts that involve the property will need to be updated to list your business entity information as the owner of the property.

The entire process has a few steps, it usually is pretty quick once your lender approves the transaction, and you create a contract for your title company.

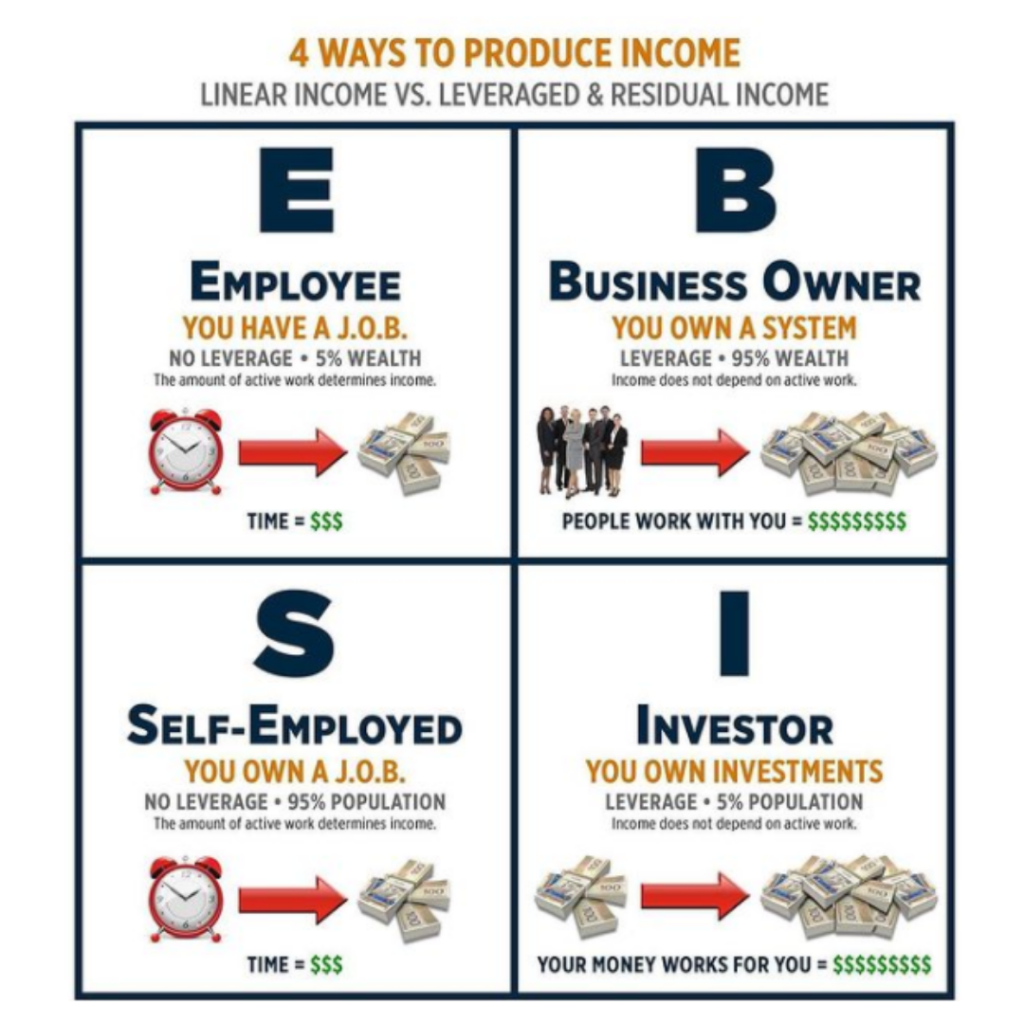

While Fola Financial is not a licensed real estate company, its Founder and CEO, Sheneya Wilson is an active real estate investor and emphasizes the ability of real estate ownership to create generational wealth.

Interested in learning how to get started in real estate investment?

Join the Real in Real Estate master class, led by Sheneya Wilson on August 3 and 4th!